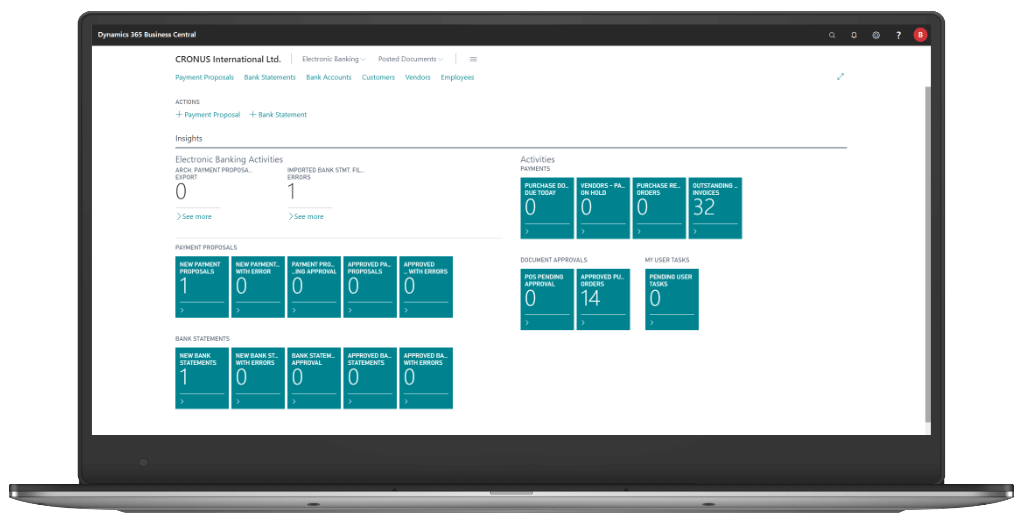

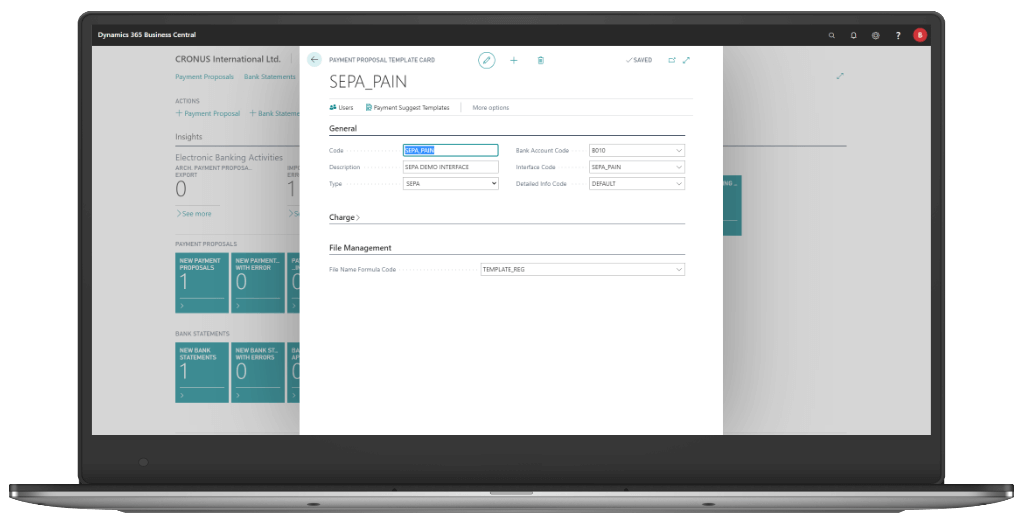

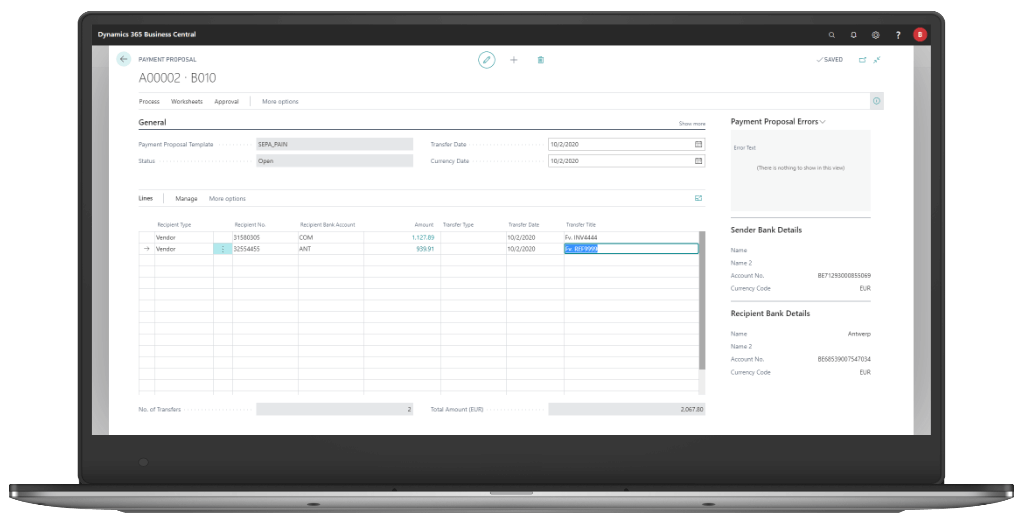

How to better manage electronic banking in Dynamics 365 Business Central?

Electronic Banking is an extension of the standard electronic banking functionality in the ERP Microsoft Dynamics 365 Business Central system. Our solution enables the integration of the system with banks. It improves the handling of payment transfers to banks and the import of bank statements, as well as the settlement of payment transactions in Business Central.