29 Jul IFRS or US GAAP vs. Global (Group) Chart of Accounts

Charts of accounts may vary substantially from country to country. This might be a result of different accounting principles, local habits or local requirements. In some countries, local laws define the layout of such charts of accounts and general ledger numbering very strictly; whereas in others, custom charts of accounts can be used, provided that they generate a specific balance sheet and profit and loss account. In multi-subsidiary international companies, the variety of patterns for charts of accounts is a challenge to cope with. Global companies manage the problem of country-based inconsistencies by implementing their global/group chart of accountswhich enables a reliable comparison and monitoring of financial data. The key purpose is tostandardize data across subsidiaries and to apply uniform valuation and classification methods for all profit and loss account components.

Logo of IFRS.

Which standard is “the standard”?

International Financial Reporting Standards (originally called International Accounting Standards), when applied, ensure uniformity across the company, thus supporting the implementation of a global/group chart of accounts. However, in some countries local standards turn out to have a critical impact on chart of accounts templates. United States Generally Accepted Accounting Principles (GAAP) is the flagship example of such standards. Its dominant role is due to the requirements of the American Stock Exchange which oblige listed companies to provide GAAP-compliant reports. Thus, GAAP is also implemented as a company or corporate accounting standard. In turn, European companies tend to apply IFRS. The clash between IFRS and GAAP appears when one of the companies within the group is listed at the American Stock Exchange which means that GAAP-based reporting requirements prevail. Nevertheless, the differences between IFRS and GAAP reporting standards are not always of critical impact on the chart of accounts, including the off-balance accounts. Off-balance accounts are required only by US GAAP to post account differences. The key components such as assets, liabilities, costs and revenues are the same, the difference lies in the classification method. In the case of GAAP, the fixed asset value (above 10,000 $) is the classification determinant, whereas IFRS classification depends on time-usage (meaning that only assets owned by the company for a period longer than one year can be included). Notwithstanding, the standards used, the chart of accounts includes the same fixed assets accounts; however different assets can be posted to these accounts.

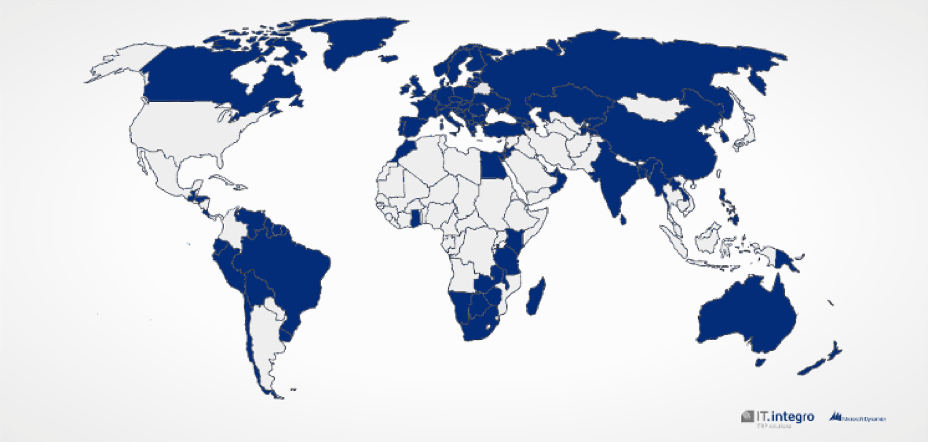

IFRS adoption by country.

Reconciling local and global requirements

When designing their chart of accounts, global companies need to provide for all accounting standards to enable both local and global reporting. The group chart of accounts is to collect all required information and classify financial data to enable the company to generate valid reports both on a corporate and local level. Thus, a group/global chart of accounts plays an ancillary function towards all accounting principles defined for the group. For a global company, establishing its chart of accounts is a complex task as it incorporates a compromise between local and global requirements and various approaches to account classification.

Why do we need group / global chart of accounts?

The aim of creating a uniform chart of accounts is firstly to harmonize data and define the way specific transactions are interpreted in local companies within the group. At the bottom of this, is standardization of businesses processes. Identical and structured processes generate standardized data output. As a result, interpretation errors are eliminated and consistency within the group is ensured, which is a prerequisite to creating a chart of accounts. A reliable and accurate chart of accounts can streamline consolidation, reporting and analytical processes. That is why, it should be created with company’s needs in mind. However, if the company is to submit its financial reports to financial authorities or to a stock exchange, IFRS as a standard defines the structure of a chart of accounts and transaction classification principles.